Worry, Me, Not Yet.

Exploring how the underlying strength of US corporate earnings and consumer credit provides a resilient foundation for navigating new trade tariffs.

Summary:

While increased demand for industrial equipment and labor creates a risk of inflation in 2026, these economic shifts are expected to reinvigorate the supply chain and improve national security through manufacturing independence.

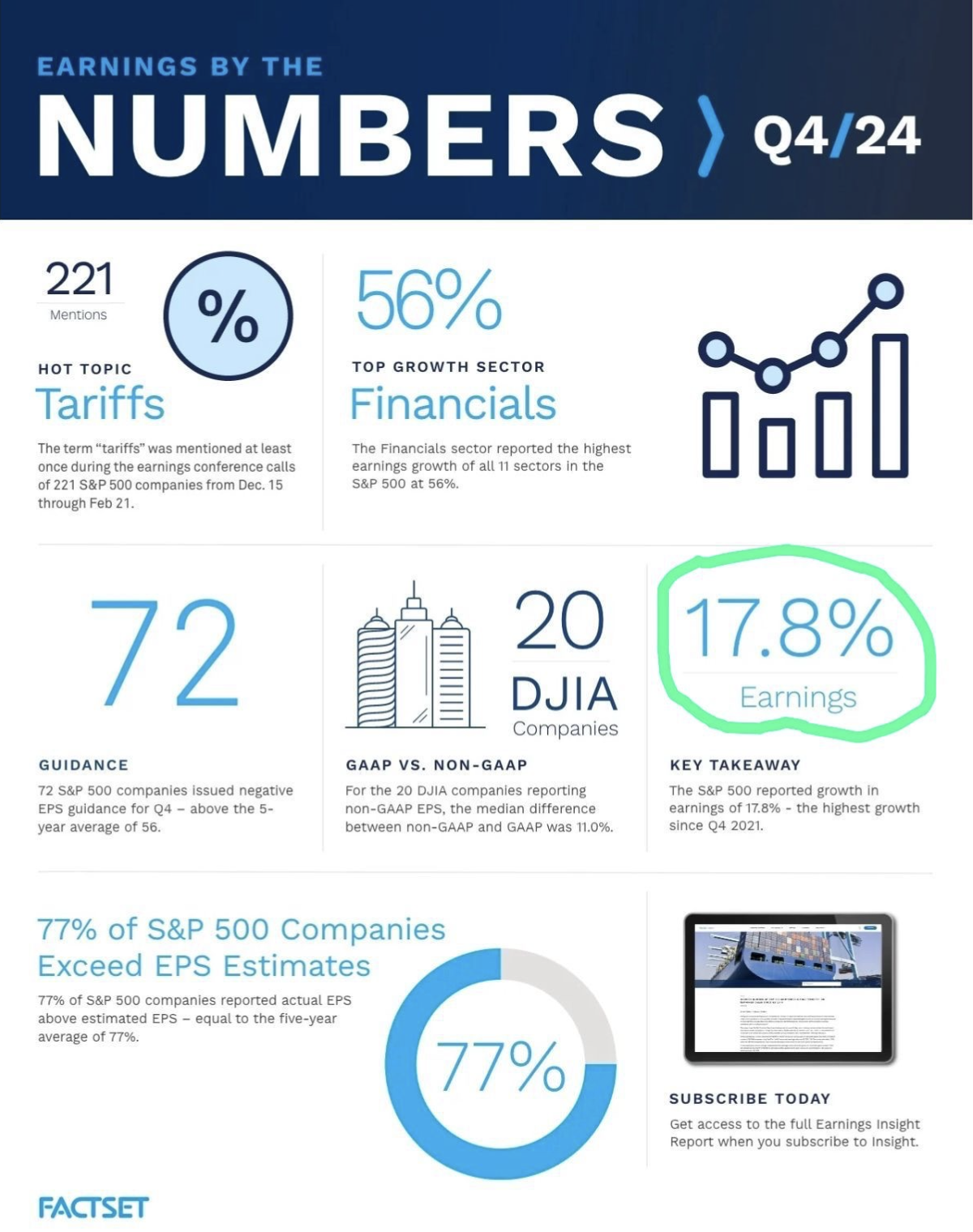

Despite political uncertainties leading to record-high negative corporate outlooks, Q4 2024 earnings exceeded high expectations, with 77% of S&P 500 companies beating EPS estimates.

Recent market retracements have removed earlier exuberance regarding deregulation and tax cuts, placing the market on a stronger footing with healthy consumer and corporate credit levels.

Moving forward, investors should differentiate companies based on pricing power, margin resilience, and leverage, while the firm intends to increase allocations to China and Asia on dips before reassessing the landscape after the administration's first 100 days.

Trump announced 25% tariffs on the EU and an additional 10% on China. These actions have prompted European carmakers to consider building more manufacturing plants or upgrading their capabilities in the US. More will follow over the next few years.

China's silence is a concern. On the other hand, US officials, including Rubio, suggest that while both parties remain strong competitors, more communication is needed.

Trump’s moves follow the plot of his strategic narrative, which he outlined during the campaign trail and his first couple of weeks in office.

Trump’s recent moves have affirmed our view that construction, resources, energy, and manufacturing will do well in the medium term and will support stronger consumerism as employment remains stable.

There will be an increased risk of inflation in 2026, with increased construction activities unless material and resource prices remain soft with ample supply. The most important component amongst them would be energy, which forms the foundation, as energy consumption is key for two sectors.

Further, demand for tooling, industrial equipment, etc., and labour will increase rapidly. Prices for these will increase in a capitalistic market where supply and demand determine prices. Still, this would generate economic activity, reinvigorate the manufacturing sector and supply chain, and improve profit. Further, manufacturing independence is an important aspect of national security. All these will lead to higher tax collection.

There will be an impact on discretionary spending on imported goods, and sales may decline due to higher tariffs. This is not necessarily negative, as spending is not directed towards non-economic generating items. However, if the consumption of imported goods does not decrease, this will also support government revenue. European luxury goods companies face the largest losses. Conversely, China focuses on large-scale production at highly competitive prices. The evidence from Nike and Apple's gross margins provides insight into the low production costs, indicating that tariffs will not completely render them uncompetitive but will make production in the US more appealing for some companies.

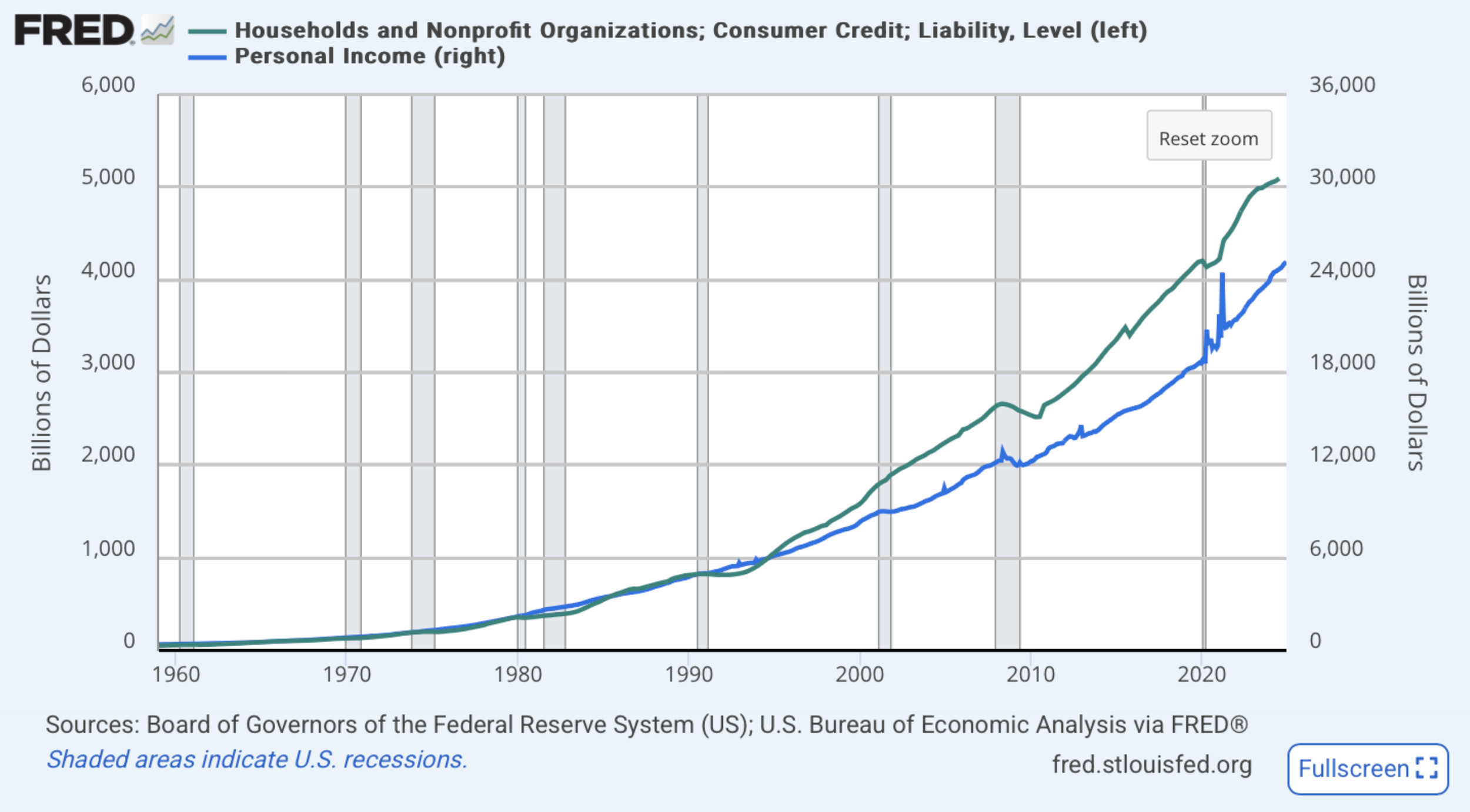

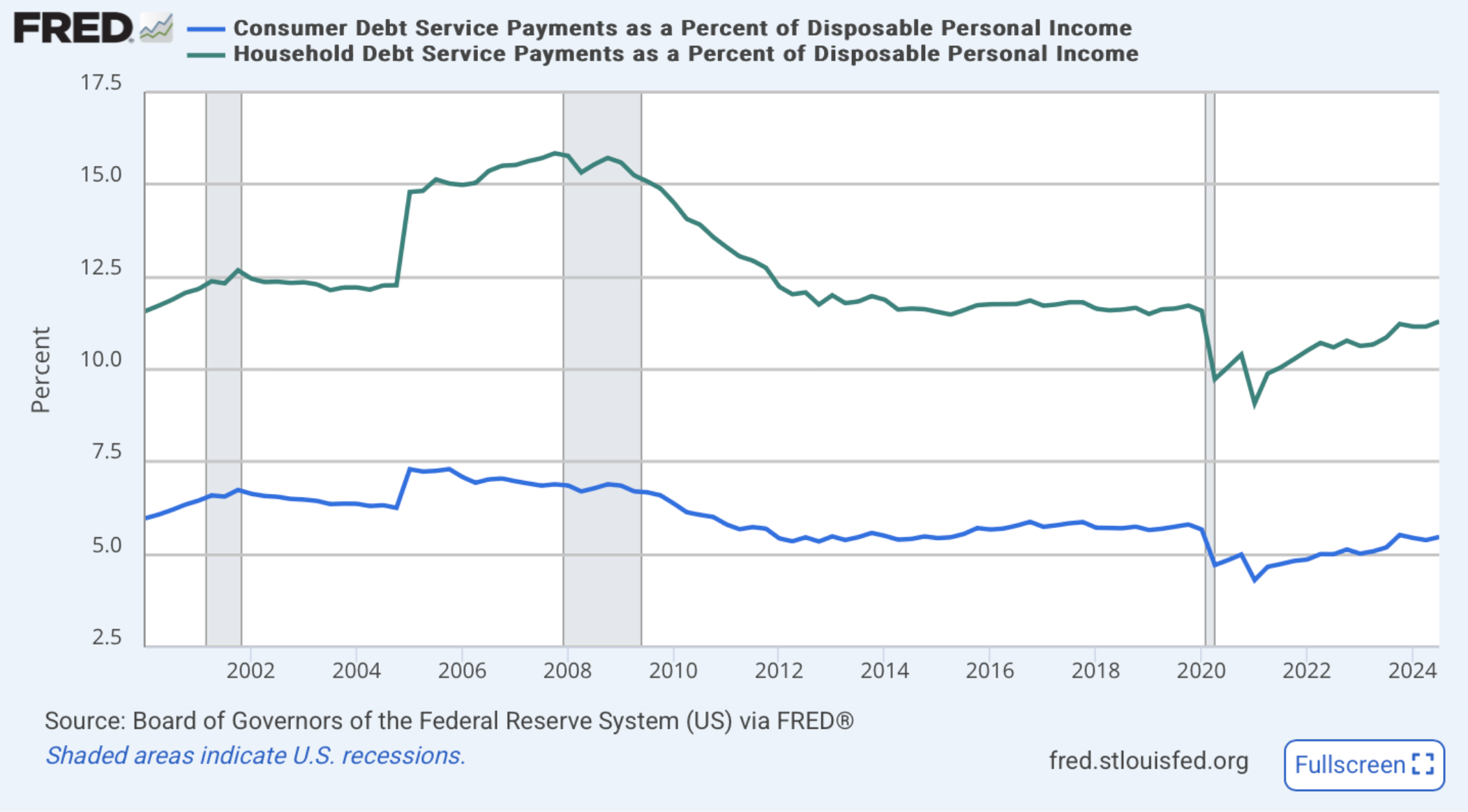

Moreover, the strong economic and corporate health today should provide a solid backdrop for making significant changes, as the system would be capable of absorbing shocks resulting from these adjustments. 4Q24 corporate earnings have exceeded the high expectation of 11.9% growth. The political uncertainties stemming from Trump’s actions have led to corporations issuing a record high of negative outlooks. This has contributed to weak market activity, which has removed excess from the market, allowing more time for the situation to unfold. The valuations are not at exuberant levels. Consumer and corporate credit are in a healthy state, except for some sectors that have been discussed repeatedly over the last 18 months, and this has nothing to do with AI.

Looking back at the earnings forecast for 4Q24, it initially stood at 14.9% at the close of September 2024. However, by January 15th, it was revised down to 11.9%. I was worried that companies, especially in the financial sector, might not meet the high expectations imposed on them, which could trigger a sell-off. Nevertheless, earnings across various sectors have surpassed expectations much more than predicted.

Why has the market been so anxious recently?

The run-up in February showed signs of exuberance. The S&P 500 at 6,200 this early in the year did not rationally consider the impact of tariffs on businesses, focusing instead only on the potential benefits of deregulation and tax cuts. This retracement has eliminated the excess and provided a stronger footing for the remainder of the year.

This does not remove the investment thesis and opportunities that were laid out at the start of the year.

From here, the market will have to reassess and bifurcate companies where:

those with gross margin adversely affected and those that are not,

those that are predominantly supplying to the domestic market that has little pricing elasticity and those that have pricing power;

goods companies versus software companies;

staples versus growth and efficient companies; and

high-debt companies versus low-leverage companies.

While there are some weaknesses in retail sales, consumer confidence and jobless claims, these data are less concerning given that, generally, January data tend to be volatile (this time due to weather and the California fire).

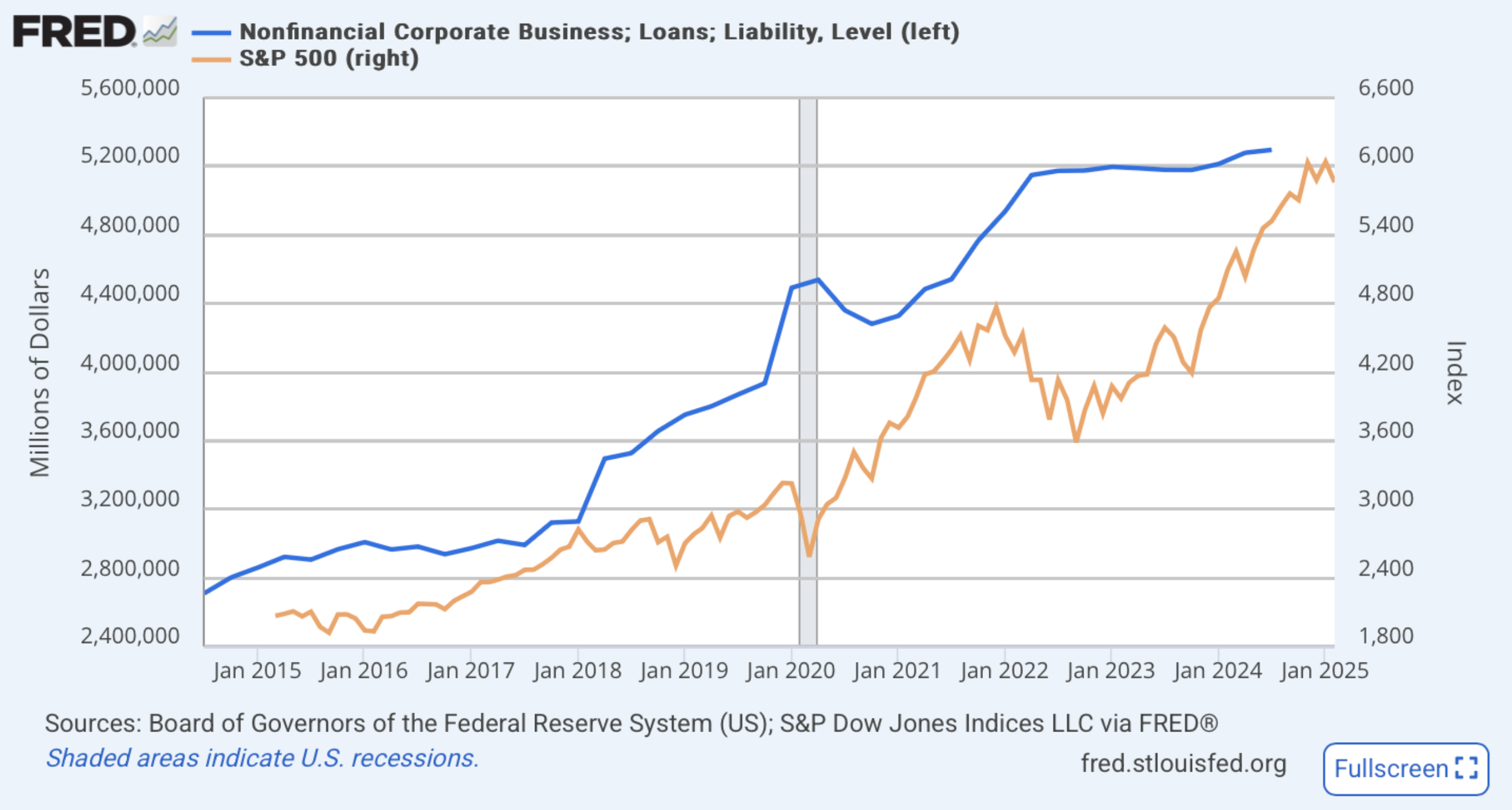

Corporate borrowing has remained flat among corporations since 2022, while EPS and market cap continue to grow. Hence, from a debt/equity or debt/EBITDA perspective, this is not worrying.

Specifically, the performing sector remains, leverage remains low, and CRE seems to be doing better. However, that does not eliminate the risk of Private Credit failures now that it has made it to the ETF, and lending standards may deteriorate in a competitive market as economic growth and EPS get pressured from tariffs and input cost inflation.

We will allow the policy announcement to play out and the negotiations to begin, and at the end of 100 days of the Trump Administration, we will reassess the landscape.

In the meantime, the allocation toward China and Asia will be increased on dips.

Related Insights